Over the past few weeks we have had a look at the Taxation Regime in Kenya and its relation to Real Estate Development.

This is the last deposit of the 6-Part- Series. We trust our readers have gained a deeper insight on the ensuing issues. The First Part of the Series can be read HERE.

Economic Impact of Taxes on Real Estate

From a reality point of view, taxes reduce the income of individuals and businesses. Lower income affects the allocation of productive resources in subsequent investment cycles, it affects consumer buying patterns and general productivity and growth of the economy.

Resource Allocation

When a tax is levied on a good or service, the cost of production rises, which shifts the supply curve to the left. The decrease in supply, if demand remains unchanged, raises the price of the product.

Real Estate is a product and the apparent high cost of it makes persons react to the higher price by buying less of the product.

This shift defeats the government policy of giving Kenyans affordable housing.

Behavior Adjustment

When there is less demand for Real Estate due to high taxes, some industry directly linked to the Construction sector cut back on production due to a fall in sales. Some workers may lose jobs.

Productive resources- land, capital, labour, and entrepreneurship- are allocated to another industry, or go unused.

This grossly explains the high levels of persons holding onto under-developed Land Resources.

A very high tax regime is counter-productive since the high taxes work like a SIN TAX. It become sort of sin or evil to develop land and persons tend to abhor the act altogether if they don?t feel that charitable.

Productivity & Growth

If persons think taxes are too high, it can hinder productivity and economic growth since a greater portion of their returns on investment goes towards defraying the taxation burden. Why? They argue, should a person seek to earn additional income if much of it would be paid in taxes?

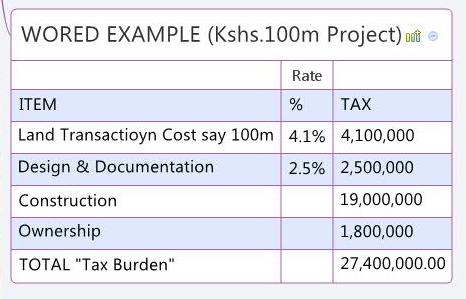

WORKED EXAMPLE (for an Kshs.100m Project)

PRACTICAL SOLUTIONS FOR LAND OWNERS/ GOVT/ DEVELOPERS

a)?Partnership- Land Owners can partner with real estate developers for package deals where the costs and benefits are shared. Think of Joint Venture arrangements, Design-Build-Operate-Transfer. This would greatly lower costs and provide a pseudo cushion for the developer.

b)?Optimize?Tax Efficiencies: When structuring Real Estate Projects, the best practice is to optimize the project as to take advantage of the tax regime. To make Kenya more attractive to Private Equity Investors and other entities wishing to invest in Real Estate, the Government can explore the advantage of using Tax Treaties. Mauritius and South Africa are at the forefront of exploring this advantage where certain taxes are ?switched off? to boost Investment.

c)?Revise Taxation ? To spur economic activity, the government can lower taxation on direct inputs e.g. Cement, VAT etc

d)?Lobbying -Players in the industry can lobby and dialogue with the government to reduce the taxes.

Lobbying can also be done through recognized forums like?the Kenya Alliance of Residents Associations.

e)?Withholding of Payments- Associations like Nairobi Residents Association are of the opinion that where the City Council provides no services, no rates should be paid.

The Other Parts of the Series are

Part 1 |?An Overview

Part 2 |?Land transaction Costs

Part 3 |?Consultancy Fees/Costs

Part 4 |?Construction Costs/Taxes

Part 5 |?Ownership Costs

REFERENCE | FURTHER READING

- Economics, Principles & Practices by Glencoe Social Studies

- Tax Regime With Particular Reference to the Construction Industry- Qs. Isabella N. Wachira

Qs. Nahinga for @UjenziBora Investment Limited

?

sports illustrated westminster dog show 2012 words with friends words with friends phlebotomy survivor dog show

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.